Out Of This World Tips About How To Avoid Chargebacks

Follow payment processing protocols use a recognizable merchant descriptor.

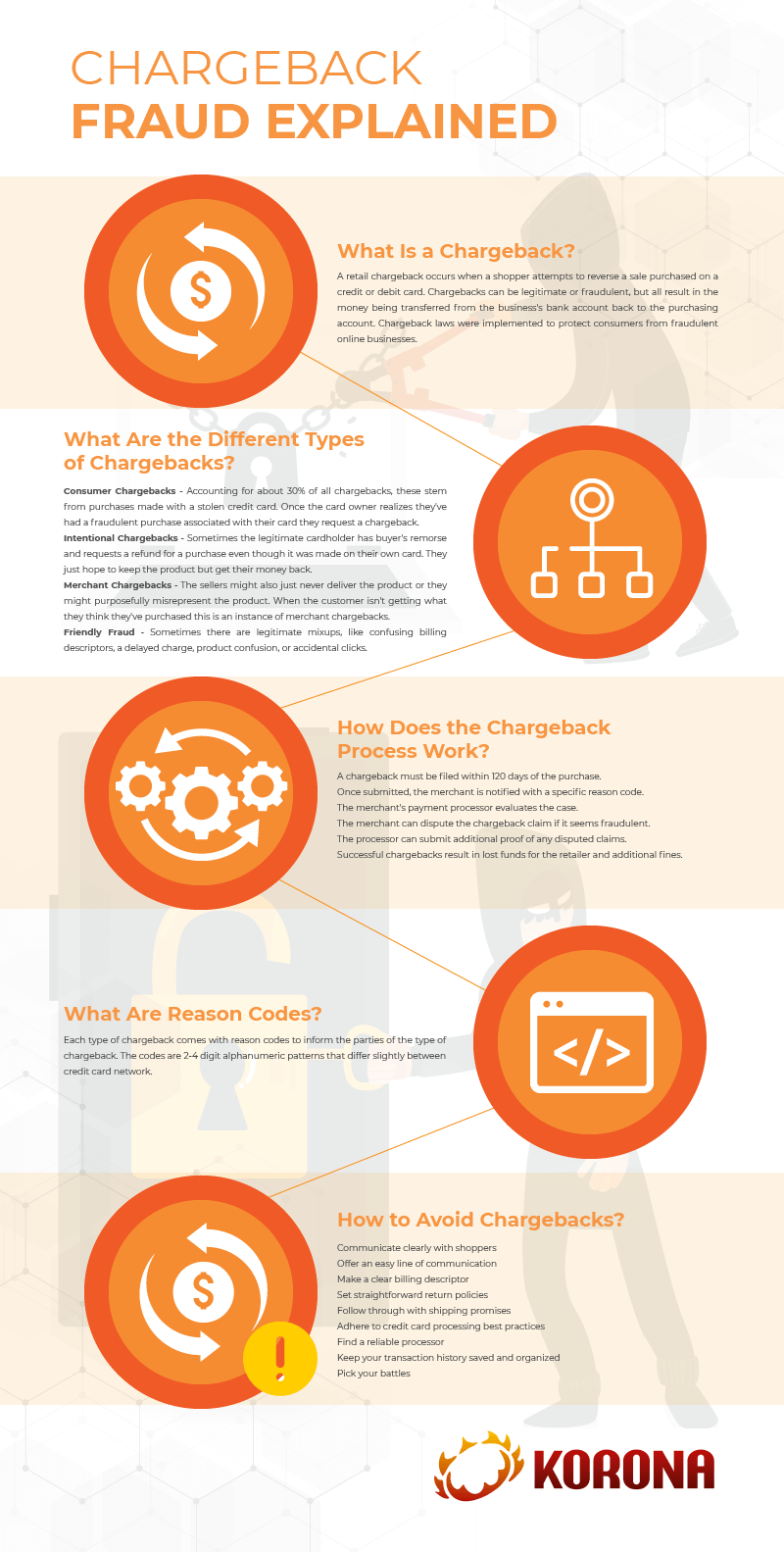

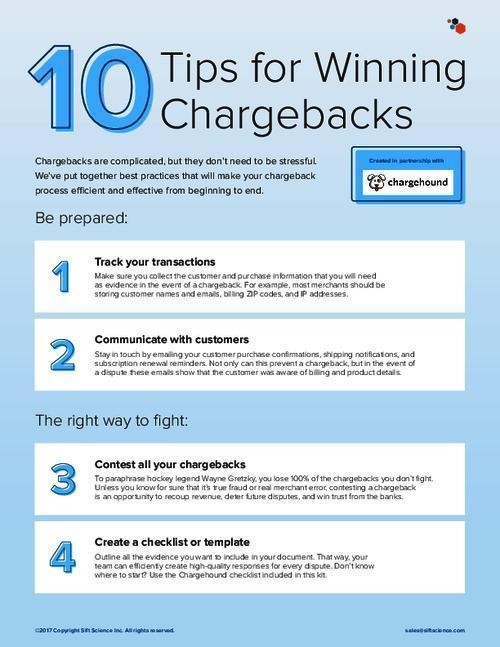

How to avoid chargebacks. A chargeback is when an issuing bank forcibly returns funds to a consumer, reversing a prior transfer. Merchants can fight chargebacks by submitting a second presentment of the transaction along with evidence proving that the cardholder’s claims are not a valid basis for a. Respond to all reasonable customer inquiries quickly and professionally.

There are a few different things you can do to protect yourself from chargebacks when trading in the marketplace: Chargebacks can be troublesome to merchants if they occur frequently, and they can also accrue additional fees from the processor. One of the simplest things you can do to prevent chargebacks is to manage your customers’ expectations by providing them with clear product specifications, response times,.

The best ways to prevent chargebacks set customer expectations. In a perfect world, everything about running your business would be smooth. A clear, concise, and accessible return policy is the first line of defense against.

For now, however, here are seven basic tips merchants can use to prevent chargebacks: How to prevent chargebacks 1. Here are six ways to avoid chargebacks.

Other ways to avoid chargebacks include: One way you can avoid chargebacks is by partnering with sipscience. If a customer tells you that they’re going to file a chargeback with.

Credit card disputes are bound to happen sooner or later. If it’s a big dispute, you. 9 ways to avoid chargebacks and credit disputes.